We are a manifestation of a series of choices made by our past self. It is funny because I never expect myself to pick up finance in University. Everyone around me thought that I will be an engineer because of good grades in Math and Science during my secondary school days. The decision to study Banking & Finance was not an easy one because I came in with the expectation to study Marketing – a field where it seems more vibrant and energetic – something to my liking. However, I knew that I needed to capitalise on my edge of being student debt-free and having a decent sum of money to invest. Hence I made a big decision to study finance, with the objective to know more about personal finance and investing.

When I was in University, I took a wealth management module that taught us how to plan our personal finances. It opened my eyes and through this course I was enlightened on why we do certain things; such as why do we buy insurance, why do we invest, etc.

Hence, to consolidate my learning and to help my friends out there who have no idea why this is important, I will be writing a 3-part series of elaborating the entire process. Below is a summary of what I will talk about:

- Know your Client (KYC) – i.e. yourself

- Insurance – hedging human capital

- Goals & Needs

- Risk Profile

- Investment Strategy

I will be adapting some of the parts that I’ve learnt and use it in a way that suits my style better.

Know your Client (KYC) – Yourself!

First, conduct a personal profile for yourself of your finances. Create a balance sheet & your income statement. State your dependents and the relevant expenses that you incur on them.

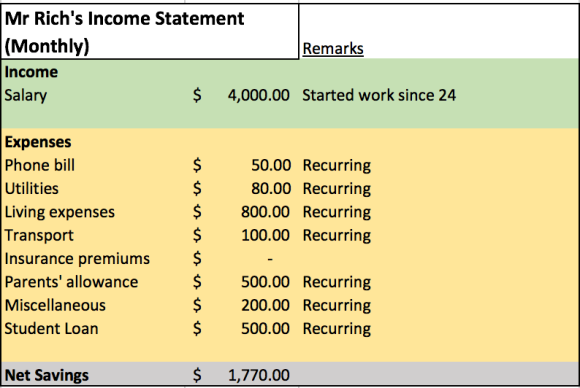

Let’s go with this hypothetical person for example. Mr Rich’s personal profile is as such:

His dependents are as such:

Below are his personal balance sheet which states his assets and liabilities and his personal income statement that records his income and expenses.

By consolidating these information, we can better understand Mr Rich’s cash flows, spending habits, and his net worth. The assumed data is simplified to focus on the process of planning your finances.

Insurance – hedging human capital

The purpose of health insurance is to hedge against unforeseen circumstances such as death, total/partial permanent disability, critical illnesses, or accidents. Simply put, it is to minimise the risk of you losing your earning potential. Insurance helps defray the cost of the treatment so that you do not have to put a huge dent in your savings or cash out your investments – which slows you down from achieving your financial goals. This concept also applies to general insurance such as car or home insurance – to cover for current and future expenses by paying a small premium compared to the the huge payment required due to unforeseen circumstances.

The question is not “Is insurance important?” but, “How much insurance is sufficient?”. In order to not buy more than what is needed, we have to calculate approximately how much coverage is suitable for Mr Rich.

First, we have to state his liabilities:

As well as the expenses that he has to incur if he is unable to work

Case 1:

Should anything happen to Mr Rich today i.e an accident resulting in Mr Rich’s inability to work, he would require $16,000 to pay off all his liabilities and a minimum of $1,730 ($2,230 – $500 from student loan) per month to pay for his living expenses.

Let’s also assume that he would require a further $800 for after-care services and related medical expenses. That will be a total of $2,530 per month or $30,360 per year

Assuming Mr Rich is still alive and has to incur these expenses for as long as he is alive, he has to have a coverage of at least $623,200

This is assuming that he is unable to work at all and the returns from the investment portfolio is after inflation.

Case 2:

However, if he is able to earn at least $1,000 per month, he is able to reduce his insurance coverage to $382,200

Case 3:

Assuming Mr Rich unfortunately passed away, his family will need $26,000 to pay off his existing liabilities (including $10,000 funeral expenses) and an additional $3,000 per month for 20 years to provide for his parents’ post-retirement expenses,

For this case, it is assumed that his parents stop working after Mr Rich passes away. However, Mr Dad can still carry on driving his taxi and supplement the household with his income.

According to the 3 different cases presented, Mr Rich would require insurance plans with a coverage of approximately $750,000 for death, total permanent disability and critical illness. This lump sum could help defray expenses that he incurs in the future should he be unable to work.

I understand that the calculations may be a little simplistic, but it is the concept that is important! This only provides a rough estimate on how much coverage is needed so that we do not pay more premiums than what is needed. After all, we might not even need to use the insurance policies if we are healthy and well. The extra premiums from overpaying a policy that we do not need can be better utilised such as channelling it to our investments.

Do let me know if you have any thoughts about these calculations and if it makes sense thus far! Leave a comment or your thoughts below!

In the next post, I will be talking about step 3 & 4 – Goals & Needs as well as Risk Profile.

Gentle note: I am not a professional in this field, I am simply sharing what I’ve learnt. If you wish to seek professional advice regarding financial planning, please seek a certified financial planner for their advice.

[…] If you haven’t check out Part 1 of Personal Finance Planning Process, click here. […]

LikeLike

[…] Part 1 of Personal Finance Planning Process, we’ve discussed about Mr Rich, a hypothetical character that I have made up to help us […]

LikeLike